The $30 Trillion Secret Women Don't Know About: 7 Wealth-Building Strategies That Turn Real Estate Challenges into Empire Opportunities

- Business and Real Estate

- Nov 13, 2025

- 4 min read

Here's something that'll blow your mind: by 2030, women are expected to inherit over $30 trillion in assets. That's trillion with a T. But here's the kicker – most women have no clue how to turn that opportunity into lasting wealth that builds generational empires.

While everyone's talking about this massive wealth transfer, they're missing the real conversation: What are you going to DO with it once it hits your bank account?

Real estate isn't just about buying a house anymore. It's about building systems that work for you while you sleep, travel, or build your next venture. And honestly? Women are naturally wired for this kind of strategic thinking – we just need the right playbook.

Strategy 1: Master the BRRRR Method (Your Money-Making Machine)

Let me break down the game-changer that's creating millionaires: Buy, Rehab, Rent, Refinance, Repeat. This isn't just real estate jargon – it's your blueprint for turning one property into ten without constantly draining your savings.

Here's how it works: You buy an undervalued property, fix it up smart (not fancy), rent it out for monthly cash flow, then refinance to pull your money back out. Now you've got a cash-flowing asset AND your original investment back to do it all over again.

Think of it like this – instead of your money sitting in one property for 30 years, you're recycling it every 12-18 months into new opportunities. That's how women are building portfolios of 10+ properties while their friends are still saving up for their second investment.

Strategy 2: Build Passive Income That Actually Works

Forget the side hustle burnout. Real passive income means money flowing in whether you're at your daughter's recital or taking that girls' trip to Dubai you've been planning.

The magic happens when you focus on both cash flow AND appreciation. Your tenants pay down your mortgage while your property values increase. It's like having your cake and eating it too, except the cake keeps growing.

One of our clients, a marketing executive from Toronto, started with one duplex. Three years later, she's collecting $4,800 monthly from her rental portfolio. That's her car payment, groceries, and vacation fund handled – all from properties that are appreciating in value.

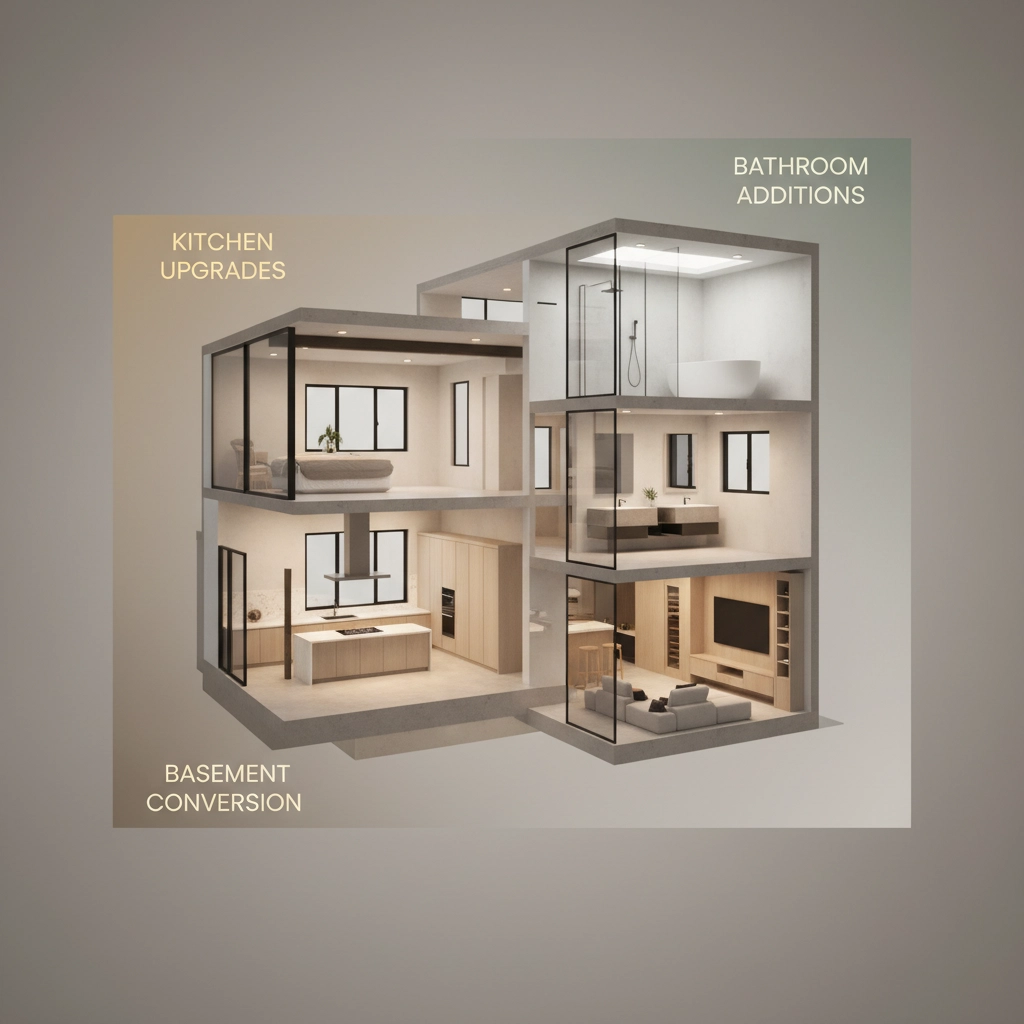

Strategy 3: Strategic Renovations That Multiply Value

This isn't about granite countertops and subway tile (though those are nice). Smart renovations target improvements that tenants will pay premium rent for and that significantly bump your property's appraised value.

Focus on:

Adding bedrooms or bathrooms where possible

Creating in-law suites or basement apartments

Energy-efficient upgrades that reduce tenant utility costs

Curb appeal improvements that photograph well online

The goal isn't to create your dream home – it's to create maximum return on investment. A $15,000 renovation that adds $40,000 in value and $300 monthly rent? That's empire-building math right there.

Strategy 4: Leverage Your Equity Like a Pro

Here's where women often get stuck: we're too conservative with leverage. But smart leverage isn't risky – it's strategic.

When your property appreciates and you've paid down some principal, you've got equity sitting there doing nothing. Refinancing at 75% of your property's new value lets you access that equity to fund your next purchase.

Instead of waiting decades to save up for property number two, you're using your first property's success to accelerate your timeline. This is how women go from one property to ten in five years instead of fifty.

Strategy 5: Scale Through Equity Recycling

Traditional advice says pay off your mortgage and own your home free and clear. Empire builders know better.

Equity recycling means you never let your money get lazy. As soon as you've built sufficient equity in one property, you're pulling it out to acquire the next one. Your portfolio grows exponentially instead of linearly.

This strategy is particularly powerful for women of colour who might not have inherited wealth or family connections in real estate. You're using your own success to fund your expansion – creating the generational wealth your family didn't have access to.

Strategy 6: Market Research That Prevents Costly Mistakes

Bad real estate investments happen when emotions override data. Empire builders make decisions based on numbers, not feelings.

Before you buy anything, know:

Average rent for similar properties

Local vacancy rates and seasonal trends

Upcoming development that could impact values

School districts and employment centers

Crime statistics and neighborhood trajectories

We teach our clients to spend more time analyzing than touring. Pretty properties that don't make financial sense will sabotage your wealth-building goals every time.

Strategy 7: Build Your Empire Team

Trying to do real estate investing alone is like performing surgery on yourself – technically possible, but why would you?

Your empire team includes:

A real estate agent who specializes in investment properties

A mortgage broker with investor-friendly lender relationships

A property manager who handles tenant headaches

A contractor who prioritizes ROI over aesthetics

An accountant who maximizes your tax advantages

At Falesha Raquel Empire, we've seen too many brilliant women stall out because they tried to wear every hat. Your time is better spent finding deals and building relationships than unclogging toilets or chasing late rent.

Turning Challenges Into Empire Opportunities

Every obstacle in real estate is actually market inefficiency – and market inefficiencies create profit opportunities for prepared investors.

Can't find affordable properties in hot markets? Look for emerging neighborhoods where you can add value through renovation. Struggling with financing? Partner with other investors or explore creative financing strategies. Worried about tenant management? Build that into your investment criteria and team selection.

The $30 trillion wealth transfer isn't just about inheriting money – it's about having the skills and systems to multiply whatever capital comes your way. Whether you're starting with $50,000 or $500,000, these strategies scale with your resources.

Your Empire Starts Now

Real estate wealth building isn't about having perfect credit, unlimited funds, or decades of experience. It's about having the right strategies, the right team, and the courage to start where you are with what you have.

The women who will dominate the next decade of wealth creation aren't waiting for permission or perfect conditions. They're learning these systems now, building their teams today, and positioning themselves to capitalize on the biggest wealth transfer in history.

Your empire doesn't build itself. But with these seven strategies as your foundation, you're not just participating in the $30 trillion opportunity – you're multiplying it.

Ready to transform challenges into empire opportunities? The time to start building is now, and the tools are in your hands.

Comments